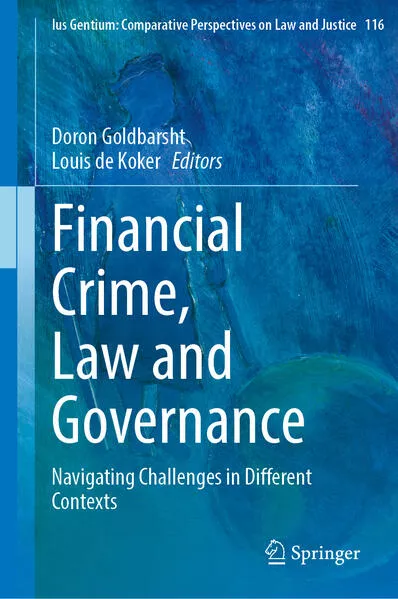

Financial Crime, Law and Governance

Navigating Challenges in Different Contexts

Embark on a journey through the dynamic landscape of global financial crime combating with our latest collection, meticulously curated by leading researchers. At the intersection of finance, technology, law, governance, and international cooperation, this multidisciplinary exploration offers profound insights into the nuanced world of financial crime across diverse jurisdictions, including Australia, Germany, New Zealand, Nigeria and the United Kingdom.

Discover a wealth of knowledge as contributors investigate facets such as asset forfeiture, non-conviction-based asset recovery, money laundering in the real estate sector, and the challenges and opportunities posed by new technologies and fintechs. Unravel the crypto crime and terror nexus and explore the necessity of public–private collaboration to combat the abuse of Non-Fungible Tokens. Dive into policy approaches, including the WireCard scandal, and understand how good governance, both public and corporate, remains paramount in the fight against financial crime.

As we navigate an age of intergovernmental rulemaking, the collection emphasizes the crucial role of robust governance frameworks and examines the impact of permissive regulation on practices in the City of London. Delve into discussions on crime risk, risk management, de-risking, and the potential consequences of overcompliance and conservative risk approaches on financial exclusion levels.

While global standards on financial crime have solidified over the past three decades, the future direction of standard-setting and compliance enforcement remains uncertain in our complex global political landscape. The collection concludes by pondering these current challenges, offering a thought-provoking exploration of what lies ahead.

This collection a product of the Financial Integrity Hub (FIH), serves as a valuable resource for financial regulators, compliance officers, and scholars, offering profound insights and perspectives to navigate the dynamic landscape of financial crime combatting.

Chapters "Non-Conviction-Based Asset Recovery in Nigeria – An Additional Tool for Law Enforcement Agencies?", "'De-risking’ Denials of Bank Services: An Over-Compliance Dilemma?" and "Terror on the Blockchain: The Emergent Crypto-Crime-Terror Nexus" are available open access under a Creative Commons Attribution 4.0 International License via link.springer.com.

Unterstütze den lokalen Buchhandel

Nutze die PLZ-Suche um einen Buchhändler in Deiner Nähe zu finden.

Bestelle dieses Buch im Internet

| Veröffentlichung: | 20.09.2024 |

| Höhe/Breite/Gewicht | H 23,5 cm / B 15,5 cm / - |

| Seiten | 353 |

| Art des Mediums | Buch [Gebundenes Buch] |

| Preis DE | EUR 181.89 |

| Preis AT | EUR 186.99 |

| Auflage | 1. Auflage |

| Reihe | Ius Gentium: Comparative Perspectives on Law and Justice |

| ISBN-13 | 978-3-031-59546-2 |

| ISBN-10 | 3031595467 |

Über den Autor

Doron Goldbarsht LLB LLM (HUJI) PHD (UNSW) is an Associate Professor at Macquarie Law School, Australia, where he teaches in the field of banking and financial crime, and also the Director of the Financial Integrity Hub (FIH). He is an authority on anti-money laundering and combating of financing of terrorism and proliferation regulations (AML/CTF), with expertise in the related fields of compliance and financial innovation. Doron’s recent books, along with his journal and chapter publications, focus on international AML/CTF standards and the mechanisms for their effective implementation and compliance at the national level.Louis de Koker LLB LLM (UFS) LLM (Cantab) LLD (UFS) FSALS is a Professor at the La Trobe Law School, Australia, and a Board Member of the Financial Integrity Hub (FIH). From 2014 to 2019, he was the national program leader of the Law and Policy research program at the Australian Government-funded Data to Decisions Cooperative Research Centre. Louis is an expert on AML/CTF and proliferation financing, especially the relationship between financial integrity and financial inclusion policies and regulations. Over the past two decades, he has worked with the Consultative Group to Assist the Poor, the World Bank, the Alliance for Financial Inclusion, and regulators and financial service providers on the design and implementation of effective and efficient AML/CFT measures that also support financial inclusion.

Diesen Artikel teilen

0 Kommentar zu diesem Buch

... weitere Publikationen von Goldbarsht, Doron

.... weitere Publikationen von Springer International Publishing

Okkultes Historiendrama über den bedeutendsten Geheimkult der Antike - Spannung, Archäologie, Liebe und Mystery

Bewerbungsfrist bis zum: 17.03.2026